"Say Hello to

Independent Financial Advice"

0191 281 8811

Client Login

0191 281 8811

Client Login

The Saudi Arabia - Russia Oil Price War

On 9th March 2020, we witnessed a 24.1% fall in the price of oil in a single day, pushing the price of a Brent barrel close to the $30 mark, whilst also pushing global equity markets further downward. The price at the time of writing of $34.36 marks a 47.94% fall since the beginning of the year, when it stood at $66[1]. In the meantime, the FTSE 100 Index has fallen by 20.9% since the beginning of the year, with a staggering 7.69% fall on the 9th of March[2].

Prior to this weekend, a long-standing deal existed between the Organisation of the Petroleum Exporting Countries (OPEC) – a cartel of some of the world’s largest oil producing countries - and Russia. Whilst Russia is not part of this cartel, they made a deal three years ago to cooperate with OPEC and help maintain production levels in line with them to support the oil price.

At the latest OPEC meeting, Saudi Arabia suggested that they continue to collectively cut their oil production by around 2.1 million barrels for each day[3]. Russia was asked to cut their production by half a million barrels; in order to maintain, or even push up oil prices which would aid the likes of Saudi Arabia, Iraq, Kuwait and the UAE, who are heavily dependent on oil exports to stimulate their economies.

Most economists believe that the cut in production suggested by OPEC was necessitated by the fall in demand for oil from China, which slowed by 20% in February due to scares from Coronavirus[4]. Russia did not like this, potentially as they did not want to cede ground to US shale producers and refused to agree to the wishes of OPEC.

Over the weekend, Russia decided to continue pumping oil and cut their prices, leaving the previous deal with OPEC in the dirt. This prompted a response from the OPEC producers who don’t want to compromise their market share and are now increasing their production whilst reducing their prices to compete with Russia.

The fall in the oil price is likely to hurt producers all over the world, particularly those who are heavily reliant upon exports and are already under pressure due to economic sanctions imposed by America, such as Iran and Venezuela. Some of these countries have no choice but to continue to produce oil and sell barrels at the currently low price as this constitutes a large proportion of their economic growth.

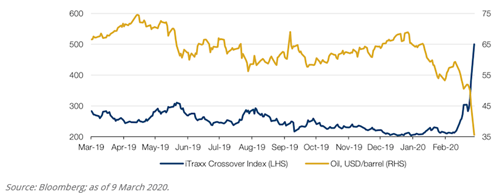

In addition to hurting oil producers, there is also a knock-on effect upon other companies, and their potential to default on debt repayments. The chart below shows the recent oil price fall and the rise in the spreads (cost of protection) of credit default swaps as measured by the iTraxx Crossover Index, which rose to more than 500 basis points on the morning of March 9th. This means that the cost of protecting against a company defaulting has risen sharply as the oil price fell, meaning markets are expecting an increase in corporate defaults.

Oil Price Vs Perceived risk of non-investment grade corporate debt default

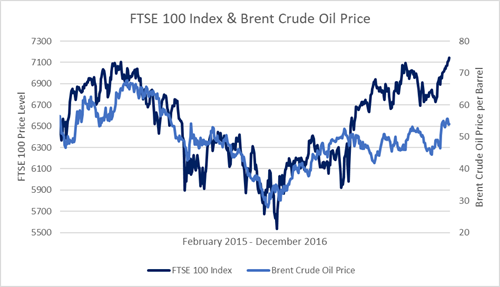

Looking back to the last oil price ‘war’ in 2015-16, markets saw the price of Brent oil fall to $27.88 on 20th January 2016, and shortly afterwards, the FTSE 100 Index fell to a trough of 5,536.97. Following this, the oil price went on to recover by the end of the year to a price over $50 per barrel, and the FTSE 100 surpassed 7,100. Although currently clouded by the effects of the Coronavirus on global economies, hopefully a conclusion to the latest spat will signal the beginning of a similar recovery in the FTSE 100 and wider markets, but it could be a long journey given that we are at a different part of the economic cycle.

Source: Bloomberg - Brent Crude Oil Price & FTSE 100 Index Price 01/02/2015-15/12/2016

[1] Oilprice.com - Crude Oil Price Data

[2] Investing.com - FTSE 100 Index Data

[3] Source: New York Times – Oil Prices Dive as Saudi Arabia Takes Aim at Russian Production https://www.nytimes.com/2020/03/08/business/saudi-arabia-oil-prices.html

[4] Bloomberg – China Oil Demand has Plunged 20% Because of the Virus Lockdown https://www.bloomberg.com/news/articles/2020-02-02/china-oil-demand-is-said-to-have-plunged-20-on-virus-lockdown

Subscribe Today

Receive exclusive

financial insights

straight to your inbox

We will use the information you have provided only to contact you in accordance to terms of this contact form and our privacy policy.

You can unsubscribe at any time by emailing enquiry@lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.

Request a Callback

To arrange a free, no obligation consultation or a call back from your Adviser, please complete your details and we will get back to you at the earliest possible opportunity. Alternatively contact us via:

A member of our team will use the details you have provided to respond to your enquiry.

You can unsubscribe at any time by emailing enquiry@Lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.