"Say Hello to

Independent Financial Advice"

0191 281 8811

Client Login

0191 281 8811

Client Login

Coronavirus

There is an old adage in investment markets that when the US sneezes the world catches a cold. Perhaps we now also need to include China. Equity markets started the year positively, helped by signs the global economy was showing signs of improvement. The advent of the coronavirus however, or to give it its official name, COVID-19, has dented this confidence and equity markets have reacted accordingly. Many markets are now in correction territory, defined as a fall of 10% or more from previous highs. The heaviest falls were initially seen in Asian markets but as the virus spread globally investors decided action was needed. Calastone, a fund trading facilitator, reported that £1.55bn was withdrawn from equity funds in the UK in February. Across all asset classes it was only the fourth month on record to see overall outflows across all asset classes.

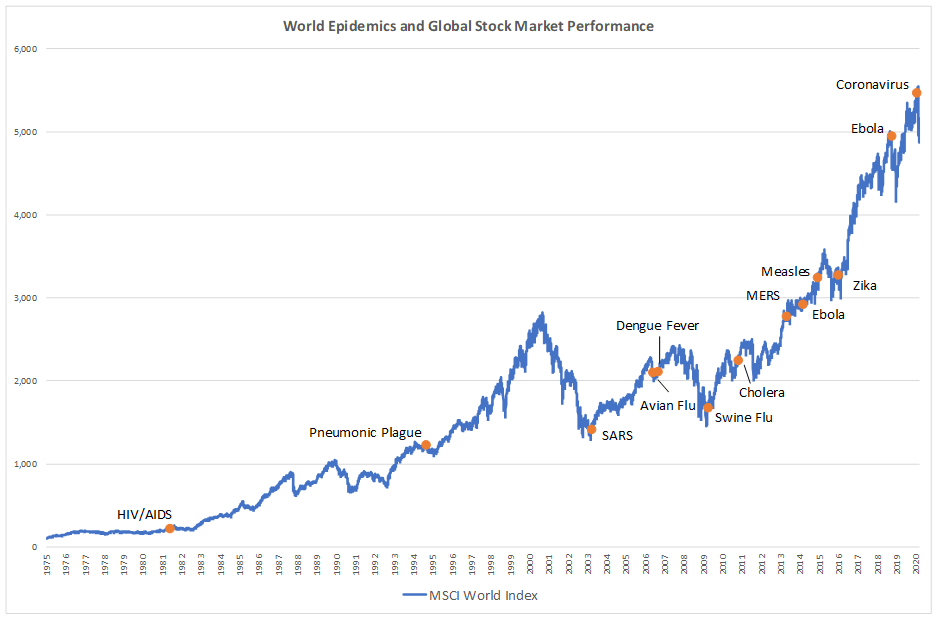

When events like this occur it sends people back to the drawing board in terms of predictions. This is wrought with difficulty when it is an unknown such as this. The temptation therefore is to revert back to history. History doesn’t necessarily repeat but it can rhyme. In the chart below we show how the MSCI World equity index has performed since 1970 to date, with previous world epidemics overlaid. The immediate conclusion drawn from this is that over the longer term the equity market has managed to continue its upward trend, eventually taking each threat from an epidemic in its stride.

Many commentators are making comparison with the SARS outbreak of 2002/3. Here we think there are some key differences, particularly relating to China. At the time of SARS, China accounted for only 3% of the global economy, it now accounts for 17%. China’s consumption has also grown exponentially. For example, in 2002 its consumption of copper was 17.8% of global consumption, it is now 53.3%. Their consumption of nickel has increased from 7.2% to 53.3%, car sales from 7.3% to 34.5% and the country is the largest consumer of smartphones. The list goes on.

Not only does China consume a vast amount but it also has an important part to play in global supply chains. This is impacting industries which rely on components from the country, such as car manufacturers like Nissan and Hyundai, who are now having to close factories due to the scarcity of parts.

The impact spreads beyond manufacturing too. McKinsey report that Chinese consumers spend more than $250bn on travel every year. With the Chinese population staying at home the industry has taken a hit. It is not only their tourism industry which is being affected but also that of the western world now that the virus has spread. EasyJet has seen their share price fall by a third since the 21 February and although it was already struggling we have seen the final demise of Flybe. Outside of tourism we have had indications from companies such as Apple, Microsoft, Pfizer and the brewer AB InBev that there is likely to be a negative impact on their earnings.

The impact of COVID-19 and the actions taken by governments around the world to contain it will clearly have a negative impact on global growth. The OECD in their March update have already downgraded global growth to 2.4% for 2020, down from their earlier estimate of 2.9%. At the same time however they did warn that a longer lasting, more intensive outbreak, spread widely through Asia, Europe and North America, could weaken prospects considerably, potentially down to 1.5%.

For now unknowns remain. Ultimately the stock market is a discounting mechanism and it will react ahead of any hard evidence as to how the economy and corporate profits have been affected. It is likely to underestimate or indeed overestimate the true impact of the coronavirus and therefore we should expect volatility until we have greater certainty. But it will turn and it will be a matter of time before the market recovers. We would therefore caution against coming out of the market and in fact would encourage taking a serious a look at adding exposure – it might not prove to be the very best time to invest but it is certainly a better opportunity than a month ago.

Finally, we should never forget that the consequences of COVID-19 extend well beyond a financial and economic impact and our thoughts go to all those affected.

Subscribe Today

Receive exclusive

financial insights

straight to your inbox

We will use the information you have provided only to contact you in accordance to terms of this contact form and our privacy policy.

You can unsubscribe at any time by emailing enquiry@lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.

Request a Callback

To arrange a free, no obligation consultation or a call back from your Adviser, please complete your details and we will get back to you at the earliest possible opportunity. Alternatively contact us via:

A member of our team will use the details you have provided to respond to your enquiry.

You can unsubscribe at any time by emailing enquiry@Lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.