"Say Hello to

Independent Financial Advice"

0191 281 8811

Client Login

0191 281 8811

Client Login

Investment Market Commentary: August 22 - January 23

Economic Backdrop

It is perhaps unsurprising that many of the economic issues which were at play in our last report were those which continued to have a significant influence throughout this last six month period. Two topics continued to dominate the market, inflation and recession, with the two, of course, interlinked. Given its importance and size, most eyes were focused on the US economy during the period and the actions/ reactions of the US Federal Reserve. As the saying goes, “when the US sneezes the rest of the world catches a cold.” It is here therefore that we shall focus our attention and commentary.

In the US we saw a marked fall in the rate of inflation. Having reached a peak of 9.1% in June, we have subsequently seen six consecutive months where inflation has declined, registering the latest reading of 6.5% in January. Whilst we have seen a fall in items such as energy costs, there remain other areas of the economy where prices continue to run hot, such as food price inflation. Much of the fall in the inflation rate can therefore be attributed to base effects. Ultimately, inflation is a rolling 12 months figure. Therefore, if, for example, the oil price was still near its highest levels, if this were the same level as 12 months earlier, the contribution to the headline inflation rate would be zero.

It is the base effect which we believe the US Federal Reserve is very much aware of. This, coupled with a very tight labour market, being why they continue with their hawkish stance. During the period we saw the central bank increase the fed funds rate further as they battled to bring inflation back towards the 2% target. Whilst the size of rate increases was dialled back from 0.75% to 0.25%, an increase at each meeting has meant that this key interest rate now stands at 4.75%, the highest level seen since 2007. The latest forecast from the central bank members predicts that interest rates will peak at 5%-5.25%, although this will of course be subject to the inflation data which continues to flow through. They then predict that this key interest rate is likely to remain here throughout 2023.

It is here that opinions are divided, with market analysts and investors, as reflected by positioning in futures contracts, expecting to see potentially two rate cuts this

year. This thought is being driven by the weakness which they are seeing in economic conditions. Having contracted at an annualised rate of -1.6% and -0.6% in the first and second quarter, the economy actually grew by 3.2% and 2.9% in the third and fourth quarter respectively. Whilst positive, market analysts are more concerned about what forward looking indicators are telling them. For example, the Conference Board Top Ten Leading Indicator Index, which includes financial and non-financial components, is now firmly pointing towards a recession. The index has a strong track record of anticipating recessions, but not so good on predicting their timing or their degree of severity. In terms of market indicators, the US Treasury 10 year-2 year yield curve has now been inverted for some time, whereby the latter has a higher yield than the former. The opposite is normally true. The level of inversion stands at a level not seen since the 1970’s/early 1980’s. Whilst in no way does this contribute towards a recession, it has historically been a relatively reliable indicator in predicting them, predicting the last eight that have occurred in the US.

Whilst concerns remain about recession, the latest International Monetary Fund (IMF) forecast for the global economy gave an uplift from their previous prediction made in October of last year. They now predict that it will grow by 2.9% in 2023, which is 0.2% higher than their earlier prediction. This is a lower rate than the expected final figure to be reported for 2022, where they estimate that the global economy grew 3.4%. It is the emerging markets and developing economies which are expected to be the drivers of global growth this year, estimating that this segment of the global economy will grow by 4%. India is forecast to continue to lead the way, closely followed by China as the country reopens following the removal of the strict Covid instructions which had created.

Developed economies however are expected to languish in comparison, with advanced economies as a collective forecast to post growth of only 1.2%. Within the G7 block of countries it is only the UK which is forecast to see its economy contract in 2023, as it struggles to retain the level which it saw before Covid in terms of the overall size of the economy. Other laggards are seen to be Germany and France, although the improved outlook for energy supplies and costs could possibly see these forecasts upgraded as we move through the year. The Japanese economy is expected to be one of the strongest performing economies in this bloc.

Equities

The performance of equity markets was mixed during the period in local currency terms, as we can see from the table below. Currency movement had less of an

impact for UK based investors over the period, with the exception of Europe, where investing from sterling meant a return of 18.21% compared to the 12.28% shown below in local currency terms.

It was a mixed period overall for equities, with all of the major indices shown in negative territory for the first three months, before seeing something of a rebound to the end of the reporting period. In the first three months equity markets as a whole grappled with the threat of an economic recession, continuing the trend seen in the prior six months. Inflation was much higher than most had anticipated and central banks in the western world were fighting to bring it under control. This created a ‘cost of living’ crisis, and was expected to place pressure on the consumers spending power. At the same time, higher inflation meant higher input costs for businesses and services. Any inability to pass on these additional costs, along with weaker consumer demand was expected to have a negative impact on corporate profitability.

Earnings, however, proved relatively resilient, meaning that company valuations derated. A common measure for valuing a company is by the price to earnings ratio, also known as the PE ratio. In periods where earnings are the same but the share price rises, the ratio becomes higher, indicating that the company has become more expensive to buy relative to the earnings it is generating. Conversely, if earnings are static but the share price falls, the valuation of the company falls, making it cheaper to buy relative to the earnings the company generates. It is this which we saw.

Moving into the second half of the reporting period markets enjoyed something of a rally. This was particularly aggressive in Europe. The region had been plagued

for most of 2022 by the threat of a lack of energy supply going into the winter months. This pushed up costs, which was expected to have a detrimental impact on corporate earnings, causing share prices to languish. The successful filling of energy storage, however, along with a milder winter, alleviated these fears. This led to a relief rally within share prices, especially in those sectors which are more cyclical and whose fortunes are more closely aligned to the performance of the domestic economy.

It was also very much a game of two halves for the Hang Seng. Between the end of July to the end of October the index fell in excess of 25% as the Chinese authorities

refused to buckle and relax their strict Covid restrictions, preventing the economy from opening fully. Investors also remained wary of further intervention from authorities as they concentrated on their ‘common prosperity’ policy. In the next three months we saw almost a complete reversal. Restrictions on social mobility were lifted, leading to hope that the pent up demand which was seen in the West on its reopening would be repeated in China. Authorities went very quiet regarding intervention in companies doings and some of the restrictions previously put on property developers were relaxed. The subsequent relief rally in the equity market was very sharp.

In the UK, meanwhile, large companies outperformed their smaller counterparts. Investors held a preference for the former in what are expected to be tougher domestic economic conditions. Larger companies typically earning a larger part of their earnings from overseas. The FTSE 100 also has a higher weighting to those sectors which could perform well in a rising interest rate environment, such as banks and financials. Oil & gas companies, along with miners, also form a large part of this index, with each expected to report an increase in profitability due to higher energy and commodity prices.

In the US meanwhile pressure remained on equities, in particular the technology sector, as profits began to slow, leading to smaller profit margins. This saw many

companies start to reduce the size of their workforce towards the end of 2022 and into 2023. It could be argued that many of these job losses were simply trimming the excess which was taken on to help meet the high demand during and post Covid. Only time will tell, but for now, pressure remains on what valuation multiple investors are willing to pay to buy back into these companies.

Fixed Income

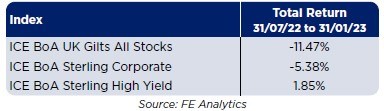

Returns across the UK fixed income asset class varied significantly over the six months, which was a very difficult period for the asset class as a whole. Both UK government and sterling investment grade credit posted a negative return for the period, although high yield, non-investment grade bonds managed to finish in the black.

Whilst the gilt index finished the period with a double digit loss, this return was significantly better than where it stood at the end of September/beginning of October. The market was already grappling with higher inflation than had been anticipated, along with central banks who, after a period of denial, were on an interest rate hiking cycle. As we reached the end of September, however, the Truss/ Kwarteng emergency budget placed severe pressure on the market, sending bond yields soaring on concerns that their proposals were not deliverable from a financial perspective. This damaged the credibility not only of the UK bond market, but also the currency. Significantly higher yields caused something of a spiral, whereby it forced liability driven investors, in particular defined return pension schemes, to sell down further their fixed income holdings, which exacerbated the issue.

It wasn’t until the Bank of England finally stepped in to bring order and stability back to the market that yields would be able to find their peak and start to recede. This retracement was also supported by the ultimate appointment of a new Chancellor of the Exchequer whose first job was to reverse all of the measures put in place at the emergency budget. This was of course followed by a new Prime Minister.

UK fixed income markets were then much stronger between the beginning of October to the end of January. Although inflation remained high in absolute terms,

there were geographies where we started to see the rate fall. This encouraged investors from a ‘rate of change’ perspective that the worst was perhaps now behind the asset class. Inflation was falling particularly in the US, where since its peak at the end of June we have now seen six consecutive months of decline.

The market still expects that we will see further interest rate increases from here, with the US forecast to peak at the 5%-5.25%, with the Bank of England, who are perhaps a little further behind the curve, expected to call a halt to rate rises at 4.5%. All forecasts are, of course, subject to change depending on the economic data releases which we continue to see. Whilst the US Federal Reserve don’t believe that there will be any interest rate cuts in 2023, the market begs to differ, with futures positioning suggesting that they expect to see two interest rate cuts before the year is out. They are basing their thesis on the belief that the worst for inflation is now behind us, coupled with the central banks needing to act to prevent a deep and damaging recession.

Whilst interest rates in the US are likely to peak in the first half of 2023, subject to no additional surprises from inflation data to the upside, it remains to be seen whether

we will simply see a pause or a full ‘Fed pivot’. Whilst this is of course in the US, it is likely to set the tone for developed bond markets around the world. For now, however, the rhetoric from developed market central banks remains more hawkish than dovish.

Structured Products

During the 6 month period there were 205 IFA distributed retail products that matured of which 42 had been ‘Preferred’ by Lowes when issued. The collective performance of the ‘Preferred’ plans again outperformed the sector average, with the capital at risk plans producing average annualised returns of 7.67% over an average term of 3.80 years, with the sector returning an average of 6.61% over 3.35 years. Structured deposits returned an average 2.75% over 4.65 years. There was one capital protected plan which matured during the period, returning an annualised 7.18% over 2 years.

To read the latest on the economy and investment market updates, please visit LowesIM.co.uk/insights

The content of this article is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in part or in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.

Subscribe Today

Receive exclusive

financial insights

straight to your inbox

We will use the information you have provided only to contact you in accordance to terms of this contact form and our privacy policy.

You can unsubscribe at any time by emailing enquiry@lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.