"Say Hello to

Independent Financial Advice"

0191 281 8811

Client Login

0191 281 8811

Client Login

Doug’s Digest: Investment bubbles

Our Investment Manager Doug Millward considers how Covid resulted in more than one type of bubble.

During the restrictions brought in for Covid, we all became familiar with the various “bubbles” we were allowed to form, with limits placed on who we were allowed to mix with and the number of people at any one time.

Investment markets have their own form of bubble too, when share prices rise faster than the fundamental data supports, leading to them rising higher than the long-term trend would suggest is correct, before quickly falling back as the bubble bursts. The biggest example in relatively recent times happened at the turn of this century, when over exuberance regarding any companies even remotely linked to the internet led to the “tech bubble” forming in 1999. This bubble did, of course, burst, with equity markets falling around the world between 2000 and 2003.

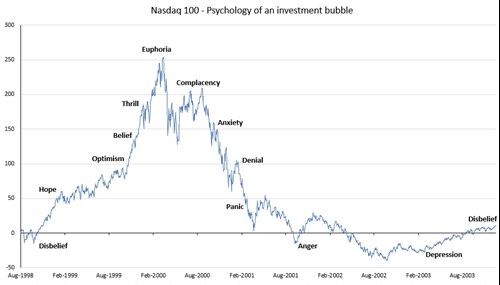

The accompanying chart of the Nasdaq 100 index, which follows the 100 largest companies on the technology heavy Nasdaq stock exchange in the United States, shows the shape of the tech bubble and is similar to the shape taken by most investment bubbles. As the labels illustrate, people are pulled in initially by optimism, and the thrill of watching their investments rise quickly leads them to tell everyone they know about the amazing company they have found. As the bubble begins to deflate, however, complacency and denial keep them invested all the way back down.

A similar bubble formed again with certain companies during the Covid pandemic. As the lockdowns forced many to not only work from home, but to shop and exercise remotely too, the value of companies benefitting from this trend unsurprisingly rose on the expectation of increasing profits.

The problem occurred, however, when the assumption was made by many investors that this was the way things would be forever going forward, that people would always work from home, shop from home, and exercise at home. As a result, the share price for companies like Peloton, who ran remote exercise classes, and Zoom, who were used by many to host work video meetings remotely as well as weekly family quizzes during the pandemic, rose to inflated levels based on this assumption. An assumption that proved to be wrong in the end.

As lock downs eased, rather than continuing their hermit like existence, people instead returned to the office and the gym. Whilst the enforced remote working had shown what was possible and introduced levels of flexibility not seen previously, it turned out people still enjoyed the physical interaction brought about by attending the workplace and the gym in person once again. With this return to previous habits, the share prices also returned to previous levels. In the case of Zoom, for example, the share price went from $68.04 at the start of 2020 to a high of $568.34 on 19th October 2020 and has now fallen back to $97.30 (14th July 2022). As can be seen from the chart, the movement in the Zoom share price followed a very similar shape to the Nasdaq index during the technology bubble in 1999 to 2003.

Of course, anyone who had sold out at the high point would have been very pleased, receiving a return of 735% in less than a year. That is assuming, however, that they had had the foresight to put their money into this one single company at the start of the year and had spotted the top of the rise correctly. Something which would have been very difficult to do, as the main narrative at that time was that remote working and an increased use of video calls were the way everyone would continue to go, so there may have been no reason to think that the share price would indeed fall.

Which highlights the difference between speculating and investing.

With investing we are looking for long term returns based on strong research, not the short-term gains from backing a hunch and getting out at exactly the right time. To use the Zoom example again, if someone had invested at the start of 2020 and then spent the next two years on a desert island, without the knowledge of what happened in between I am sure they would have been happy to return to find their investment had grown by 43%.

Diversification will always help to reduce the extremes of movements that can come from investing in just one or two companies, but even without bubbles there will still be bouts of pessimism and optimism pushing prices up and down along the way. It is important in those times not to succumb to the psychology of the investment cycle, but instead stay disciplined

to your long-term goals, relying on strong managers and good research to get you there.

Past performance is not a guide to the future.

Lowes Financial Management and Lowes Investment Management are authorised and regulated by the Financial Conduct Authority.

Subscribe Today

Receive exclusive

financial insights

straight to your inbox

We will use the information you have provided only to contact you in accordance to terms of this contact form and our privacy policy.

You can unsubscribe at any time by emailing enquiry@lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.