"Say Hello to

Independent Financial Advice"

0191 281 8811

Client Login

0191 281 8811

Client Login

Where the value is

Managing Director Ian Lowes illustrates how structured products and funds work in volatile stockmarkets and economic crises, such as we are currently experiencing.

Anyone who has been a long-term investor in structured investments will appreciate that it’s far from uncommon to receive annual valuations showing the investment is ‘worth’ less than the money invested. This is particularly the case in the early years and if markets are depressed. However, with structured investments, it pays to ignore this daily ‘noise’ and just focus on the outcome. After all, you can’t invest more at the reduced quoted value, you invested with the defined terms in mind and you have no intention of surrendering.

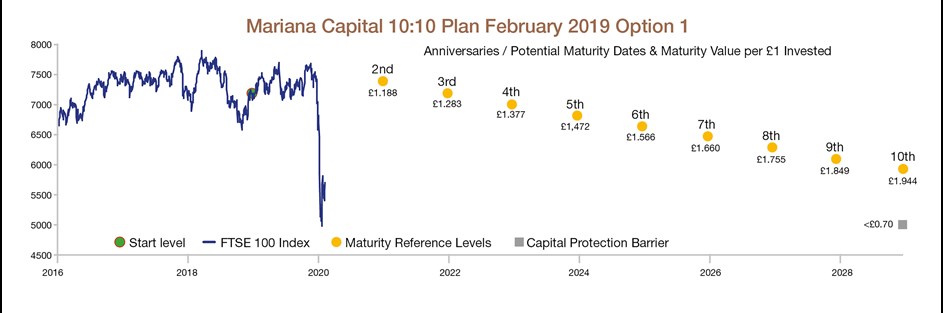

That said, funds of structured products do present an opportunity to buy in at these reduced values, so I would like to discuss what we see as the value opportunity. Let me start by reference to a live plan – Option 1 of the February 2019 10:10 Plan. In summary, this is FTSE 100 linked step down (by 2.5% pa) with first potential maturity at 7358 in February 2021. The maturity trigger level falls each year to 5922 in February 2029. The plan will give rise to a return of less that £1 per unit if the maturity triggers are never met and the FTSE is below 5025 in February 2029.

Accepting that no one saw what was coming in terms of the Coronavirus crash, this still feels like it was a good investment for the time. If it takes until 2029 for the FTSE to get back above 5922, this plan matures with a 94% gain on original capital – admittedly in nine years, but against a backdrop of the FTSE going little more than sideways from here – or plummeting and subsequently crawling its way back up. If things turn out somewhat better and the FTSE is back above 7200 points in February 2022 the plan will mature then, returning £1.28 per £1 unit.

So, I’m happy with that and I would like to think that any investor would be too, notwithstanding the fact that, with the benefit of hindsight they may have deferred their investment decision. But focusing on the defined terms and potential outcomes will help.

As to the surrender price, well you would probably rather not know. At the height of the market rout, that same investment was pricing at 58 pence in the pound! If you could, would you not buy it all day at that price? A potential return from there of up to 234% over nine years! The surrender price has since improved but at the time of writing it is still only at 81 pence. Surely you would still consider buying at that price? A potential 58% gain in less than two years if the FTSE rises 23%, or a 140% gain if it takes just under 9 years to rise just 4% and a range of possible returns for each anniversary in between.

Of course, these surrender prices are for one-way trading only – you can only surrender the plan back to the bank, not buy more of it.

Structured fund

A fund of structured investments such as the Lowes UK Defined Strategy Fund quotes the daily noise but under the bonnet there is a portfolio of many similar trades, all with defined outcomes. Of the nineteen strategies held within the fund, the nearest capital protection barrier is at FTSE 4100.4 observed in August 2025. If no capital protection barriers are breached all strategies will return at least £1 per pound invested at their eventual maturity dates.

Like the 10:10 plan, all the strategies are auto-calls where the potential gain increases each year they are in force.

Like the February 2019 10:10 Plan, the fund’s ‘surrender’ value is also depressed thanks to the recent market fall but unlike the 10:10 Plan, you can buy in at this price. At the time of writing the UKDSF is trading at 87.5p. Unless you don’t believe the FTSE 100 Index is going to recover over the next six years this fund may be worth some serious consideration as part of a portfolio.

Lowes UK Defined Strategy Fund

The Lowes UK Defined Strategy Fund was launched in October 2018 and met a need we saw for Lowes clients and other investors to be able to invest in a range of structured investments in the same way as they would a mutual fund of stocks and shares, rather than have to buy into separate products every time. The additional advantages are that there is a lower minimum investment than individual products, and the fund values daily and can be bought and sold just like any other mutual fund.

The fund aims to deliver consistent long-term capital growth, with diversification of counterparty bank exposure as well as market observation points, alongside the daily liquidity and management by our dedicated in-house Investment Team. It is worth noting that the strategies within the fund are available only to investment professionals like Lowes and as such cannot be invested in as standalone structured products.

Capital at risk. Past performance is not a guide to the future. The value of investments and the income they produce can fall as well as rise. You may get back less than you invested.

Subscribe Today

Receive exclusive

financial insights

straight to your inbox

We will use the information you have provided only to contact you in accordance to terms of this contact form and our privacy policy.

You can unsubscribe at any time by emailing enquiry@lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.

Request a Callback

To arrange a free, no obligation consultation or a call back from your Adviser, please complete your details and we will get back to you at the earliest possible opportunity. Alternatively contact us via:

A member of our team will use the details you have provided to respond to your enquiry.

You can unsubscribe at any time by emailing enquiry@Lowes.co.uk or by clicking the 'unsubscribe' link at the bottom of each email. Full details of how we use and secure your personal information and how to update your marketing preferences can be viewed in our Privacy Policy.