"Say Hello to

Independent Financial Advice"

0191 281 8811

Client Login

0191 281 8811

Client Login

Who We Are

As

Chartered Financial Planners

and

Independent Financial Advisers,

we have been providing truly Independent Financial Advice to people like you throughout the UK since 1971.

We believe that individual and dedicated client care is a central aspect of fulfilling our goal of total peace of mind for our clients. We have almost 90 committed professionals, all sharing our company ethos of “personal finances cared for personally”. So not only will you have the benefit of a dedicated personal Adviser, but also the backup of our highly qualified Technical, Investment, Research and Administration teams who help each Adviser ensure the advice given is current and suitable for your ongoing needs.

Over the years, our personal approach to financial planning has helped both clients and the company prosper and in our 2023 client satisfaction survey over 96% of our clients rated our service as 'good' or 'very good'.

We advise clients across a wide range of financial aspects such as

inheritance tax planning,

investment management,

pensions,

tax mitigation,

long term care

and other general financial planning issues with client confidentiality assured. A combined wealth of experience and industry knowledge ensures you receive financial advice which is tailored to your personal needs and expectations. Our objective is to build long-term, mutually beneficial relationships with clients and we will endeavour to act in your best interests at all times.

Providing trustworthy and valued independent financial advice since 1971

Being Independent

As an Independent Financial Adviser we provide you with an unbiased, whole of market guidance and market insight in order for you to make the best and most informed financial decisions to suit your individual circumstances.

Our Approach

Over the years our personal approach to financial planning has helped both clients and company prosper.

Chartered Financial Planners

We were one of the first firms of Independent Financial Advisers in the UK to achieve the accreditation "Chartered Financial Planners", a status something which we are justifiably very proud of.

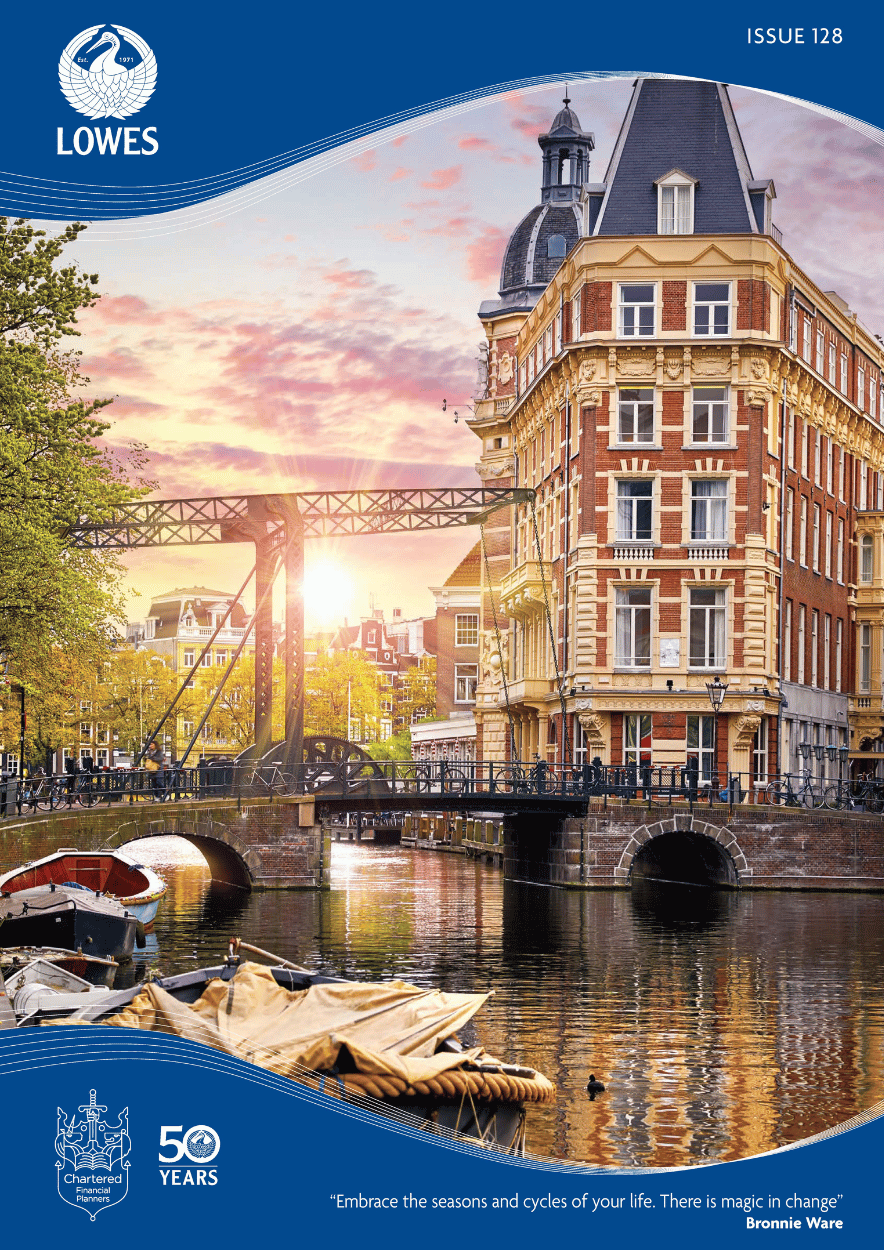

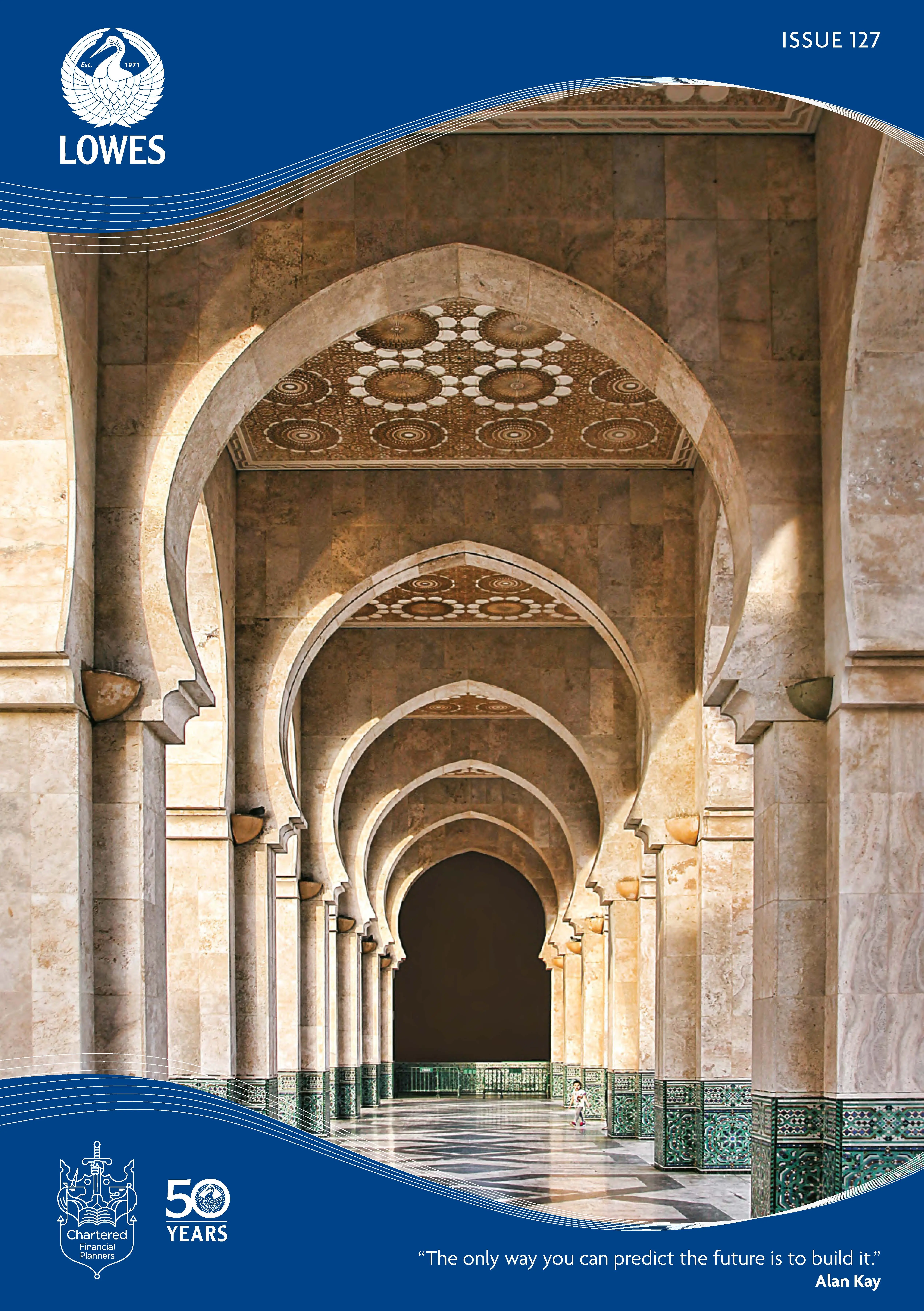

Lowes Magazine

Since 1971 Lowes has issued regular quarterly newsletters and magazines to its clients designed to keep them fully informed of all the financial issues the in house editorial team consider to be most topical and relevant at the time. The quality and content of the magazine has been acknowledged over the years and it has gained a reputation amongst clients, Journalists and other IFAs for successfully foreseeing problem areas long before they happen.